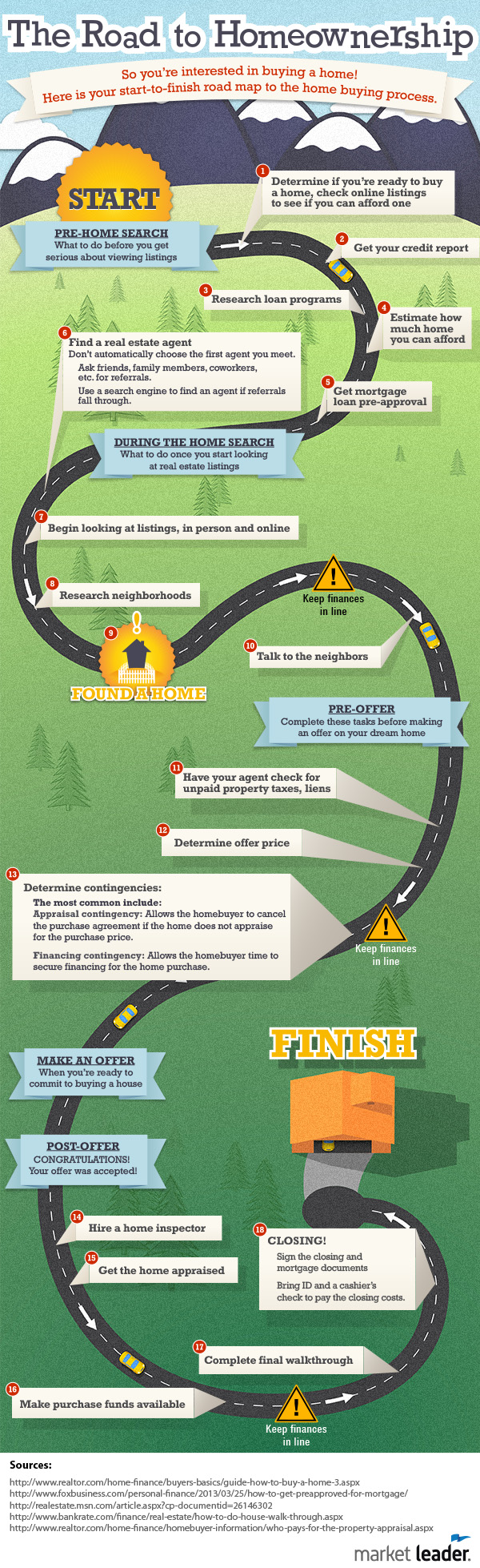

The Home Buying Roadmap of Navigating the home buying process can be overwhelming and confusing, but with the right roadmap, you can make informed decisions and achieve your dream of owning a home.

Understanding Your Home Buying Journey

When embarking on the journey of buying a new home, it’s essential to understand the various steps involved in the process. This understanding will help you navigate through the home buying journey smoothly and make informed decisions. In this section, we will delve into the key aspects of understanding your home buying journey, including researching the real estate market, assessing your budget and financial readiness, and choosing the right type of property.

Researching The Real Estate Market

Researching the real estate market forms the foundation of your home buying journey. This step involves gaining a comprehensive understanding of the current housing trends, property prices, and market conditions in your desired area.

Here are some tips to help you research the real estate market effectively:

- Use reputable online platforms and real estate websites to access up-to-date listings of available properties in your target area.

- Read blogs and articles related to the local real estate market to get insights into the current trends and developments.

- Consult with a trusted real estate agent who has in-depth knowledge of the market and can provide you with valuable guidance.

- Attend open houses in your desired area to get a feel for the neighborhood and the type of properties available.

Assessing Your Budget And Financial Readiness

Assessing your budget and financial readiness is a crucial step in determining what you can afford and avoiding any potential financial burdens in the future. Here are some key considerations when assessing your budget:

- Evaluate your current income and expenses to determine how much you can comfortably allocate towards mortgage payments.

- Consider other costs associated with homeownership, such as property taxes, homeowner’s insurance, and maintenance expenses.

- Review your credit score and address any outstanding debts or issues that could affect your ability to secure favorable loan terms.

- Save for a down payment, striving to reach the recommended 20% of the home’s purchase price to avoid paying private mortgage insurance (PMI).

Choosing The Right Type Of Property

Choosing the right type of property is a personal d ecision that depends on your lifestyle, preferences, and long-term goals. Whether you’re considering a single-family home, condominium, townhouse, or any other property type, it’s important to consider the following factors:

- Size and layout: Determine the number of bedrooms and bathrooms that would suit your needs, as well as the desired amount of living space.

- Location: Evaluate the proximity to amenities, schools, and your workplace to ensure convenience in your daily routine.

- Future potential: Consider the potential for growth and appreciation in the property’s value, especially if you plan to stay for an extended period.

- Community amenities: Research the available amenities such as parks, pools, or fitness centers that align with your lifestyle.

By taking these factors into account and following a systematic approach, you can make an informed decision when choosing the right type of property that meets your needs and complements your long-term goals.

Credit: oswegorealestategroup.com

Securing Financing For Your Home Purchase Home Buying Roadmap

Securing Financing for Your Home Purchase

Mortgage Options And Pre-approval

One of the first steps in securing financing for your home purchase is to explore mortgage options and obtain pre-approval. This will help you determine how much you can afford to borrow and give you a better idea of the type of mortgage that suits your needs.

There are various types of mortgages available, so it’s important to carefully consider your options. Some common mortgage types include:

- Fixed-rate mortgage: This is a popular option where the interest rate remains the same for the entire loan term. It provides stability and predictability in monthly payments.

- Adjustable-rate mortgage (ARM): With an ARM, the interest rate fluctuates over time, usually starting with a lower rate for an initial period. This can be beneficial if you plan to sell or refinance before the rate adjusts.

- Government-backed loans: These loans are insured by the government and typically have lower down payment requirements. Examples include FHA loans for first-time homebuyers and VA loans for veterans.

- Jumbo loans: These are loans that exceed the conforming loan limits set by Fannie Mae and Freddie Mac. They are ideal for purchasing higher-priced properties.

Once you have explored your mortgage options, it’s beneficial to get pre-approved. This involves providing financial information to a lender who will then review your credit score, income, and debts. If you meet their criteria, they will provide you with a pre-approval letter stating the maximum amount you can borrow.

Saving For A Down Payment Home Buying Roadmap

Saving for a down payment is an essential part of securing financing for your home purchase. Most lenders require a down payment, which is a percentage of the home’s purchase price that you pay upfront. The amount required can vary depending on factors such as the type of mortgage and your creditworthiness.

Here are some tips for saving for a down payment:

- Create a budget to track your income and expenses and identify areas where you can save.

- Automate your savings by setting up a separate account and regularly transferring money into it.

- Reduce unnecessary expenses, such as eating out or buying expensive gadgets.

- Consider alternative sources of funds, such as assistance programs, gifts from family members, or using funds from your retirement account (if allowed).

Understanding Closing Costs

Aside from the down payment, it’s important to understand closing costs when securing financing for your home purchase. Closing costs are the fees associated with finalizing the loan and transferring ownership of the property. These costs can vary depending on factors like location and loan type.

Some common closing costs include:

| Item | Description |

|---|---|

| Appraisal fee | The cost of having a professional appraiser determine the value of the property. |

| Loan origination fee | A fee charged by the lender for processing and initiating the loan. |

| Title insurance | Insurance that protects against any issues with the property’s title. |

| Attorney fees | Costs associated with hiring an attorney to review the closing paperwork. |

| Home inspection fee | The cost of having a professional inspect the property for potential issues. |

It’s important to budget for these closing costs in addition to your down payment. Asking the seller to cover some or all of the closing costs is also a possibility, depending on the negotiation and real estate market conditions.

Finding Your Dream Home

To embark on the exciting journey of finding your dream home, it’s important to have a clear roadmap in place. This roadmap will help you navigate the Home Buying process seamlessly while ensuring that you don’t miss out on any crucial steps. One of the most crucial phases of this roadmap is finding that perfect abode that resonates with your vision of a dream home. In this section, we will explore the three key steps that will help you in your quest for finding the perfect home.

Hiring A Real Estate Agent

When it comes to finding your dream home, an experienced and knowledgeable real estate agent can be your greatest ally. A real estate agent understands the local market dynamics, possesses access to various listing platforms, and has the expertise to negotiate on your behalf. Here are a few points to consider when hiring a realtor:

- Look for a real estate agent with a strong track record and positive client testimonials.

- Ensure that the agent specializes in the type of property you are interested in, whether it’s a single-family home, condominium, or townhouse.

- Verify that the realtor has excellent communication skills and is responsive to your queries and concerns.

Searching For Properties

Once you have a reliable real estate agent by your side, it’s time to embark on the exciting process of searching for properties that align with your dream home criteria. Here are a few strategies to make your property search efficient and fruitful:

- Clearly define your must-haves and deal-breakers, such as location, size, amenities, and budget.

- Utilize online real estate platforms, such as MLS listings or reputable real estate websites, to search for properties that match your criteria.

- Attend open houses, virtual tours, or schedule private showings with your real estate agent to physically assess the shortlisted properties.

Assessing And Comparing Potential Homes Home Buying Roadmap

Once you have discovered a few potential homes that caught your eye, it’s time to assess and compare them to determine which one truly captures your heart. Here are some key aspects to consider when assessing and comparing potential homes:

- Inspect the condition of the property, including the structure, plumbing, electrical systems, and any potential maintenance or repair requirements.

- Evaluate the neighborhood, including proximity to amenities, schools, transportation, and overall safety.

- Consider the long-term prospects of the property’s value appreciation and potential for resale.

- Weigh the pros and cons of each property and consult with your real estate agent to make an informed decision.

By following these steps and staying true to your vision, you can soon find yourself settling into your dream home, the perfect sanctuary where cherished memories will be created.

Making An Offer And Negotiating Home Buying Roadmap

When it comes to the home buying process, one of the most crucial steps is making an offer and negotiating with the sellers. This is where you put your negotiating skills to the test and work towards getting the best deal possible. In this section, we will discuss three key aspects of this process: writing a strong offer, negotiating with sellers, and understanding contingencies and terms.

Writing A Strong Offer

Writing a strong offer is essential to grab the attention of the sellers and convey your seriousness as a buyer. Here are a few key points to consider when crafting your offer:

- Offer Price: Research the market value of similar properties in the area and set a reasonable and competitive offer price. This will show the sellers that you have done your homework and are making a fair offer.

- Down Payment: The down payment amount plays a crucial role in your offer. A higher down payment indicates your financial stability and can enhance your chances of acceptance.

- Timeline: Specify a realistic timeline for offer acceptance, home inspection, and other contingencies. This allows the sellers to understand your commitment and plan accordingly.

Negotiating With Sellers

The negotiation phase is where you and the sellers try to find common ground and reach an agreement. Here are a few strategies to keep in mind during this process:

- Know Your Limits: Determine your maximum acceptable price and other terms before entering into negotiations. This will help you stay within your budget and avoid overpaying.

- Listen and Understand: Take the time to actively listen to the sellers’ concerns and understand their motivations. This can provide valuable insights and help tailor your negotiation approach.

- Offer Incentives: Consider offering incentives to sweeten the deal, such as paying for closing costs or including certain appliances in the purchase. These small gestures can make your offer more enticing.

Understanding Contingencies And Terms

Contingencies and terms are an important part of any home buying transaction. It’s crucial to fully understand these factors before finalizing the negotiation. Here are a few key points to keep in mind:

| Contingencies: | Terms: |

|---|---|

| Contingencies protect you as the buyer and give you an opportunity to back out of the deal without losing your earnest money deposit. | Terms include the specific conditions and agreements related to the purchase, such as the closing date, financing options, and home inspection results. |

| Common contingencies include financing contingency, home inspection contingency, and appraisal contingency. | Ensure that you carefully review the terms and seek clarification if anything is unclear. Don’t hesitate to consult with your real estate agent or attorney if needed. |

By writing a strong offer, negotiating effectively, and understanding contingencies and terms, you can increase your chances of securing the home you desire at a price that suits your budget. Keep these essential tips in mind as you navigate through the exciting process of making an offer and negotiating.

Closing The Deal And Beyond

Once you’ve found your dream home, there are a few crucial steps to take before officially becoming a homeowner. This section will guide you through the final stages of the home buying process, from completing the purchase agreement to conducting a home inspection and finalizing the mortgage process. Let’s dive in and learn how to navigate the waters of closing the deal and beyond.

Completing The Purchase Agreement

Completing the purchase agreement is a crucial step that solidifies your intention to buy the property. This legally binding document outlines the terms and conditions of the sale, including the purchase price, closing date, and any contingencies or special provisions. Make sure to read it thoroughly and understand every aspect before signing on the dotted line. Keep in mind that negotiating some terms may be necessary, so don’t hesitate to communicate your concerns or requests to the seller.

Conducting A Home Inspection

A home inspection is an essential part of the home buying process to ensure the property is in good condition and free of any hidden issues. Hiring a professional home inspector gives you peace of mind by thoroughly examining the house’s structure, systems, and major components. They will provide a comprehensive report detailing any defects or potential problems, allowing you to negotiate repairs or adjustments with the seller, if needed. Remember, a thorough inspection can save you from costly surprises down the road.

Finalizing The Mortgage Process Home Buying Roadmap

Finalizing the mortgage process is the last step before the keys to your new home are officially handed over to you. It involves working closely with your mortgage lender to complete the necessary paperwork, meet any remaining conditions, and secure the funds for your home purchase. This phase usually includes an appraisal of the property to ensure its value aligns with the loan amount. Be prepared to provide any additional documentation required by your lender to facilitate a smooth closing process.

Throughout the closing process and beyond, clear communication with your real estate agent, home inspector, and mortgage lender is vital. Stay organized, keep track of deadlines, and ask questions when necessary. By following this roadmap, you’ll be well-prepared to reach the exciting milestone of becoming a proud homeowner.

Frequently Asked Questions On Home Buying Roadmap

What’s The Best Strategy To Buy A House?

The best strategy to buy a house is to start by determining your budget, then researching and comparing mortgage options. Next, find a real estate agent to guide you through the process and begin visiting homes within your price range.

Finally, make an offer and negotiate the terms with the seller.

Is The Home Buying Process Stressful?

Yes, the home buying process can be stressful due to various factors like paperwork, negotiations, and financial decisions. However, with careful planning, guidance from professionals, and realistic expectations, the stress can be managed effectively.

How To Buy A House In A Fast Market Home Buying Roadmap

To buy a house in a fast market:1. Research local market trends and pricing to stay competitive. 2. Get pre-approved for a mortgage to demonstrate financial readiness. 3. Work with a reliable real estate agent experienced in fast-paced markets. 4.

Act quickly when a suitable home becomes available, making strong offers. 5. Be flexible and prioritize what’s most important to secure a successful purchase.

How Can I Start The Home Buying Process?

To start the home buying process, you can begin by saving for a down payment, improving your credit score, and getting pre-approved for a mortgage. It’s also helpful to research the local housing market and find a reputable real estate agent to guide you through the process.

Conclusion Home Buying Roadmap

To wrap up, navigating the home buying process can be overwhelming, but with the right roadmap, it becomes a smoother journey. By setting a budget, researching neighborhoods, getting pre-approved for a mortgage, and working with a trusted real estate agent, you can make informed decisions and find your dream home.

Remember, patience and persistence are key when embarking on this exciting adventure. Happy home hunting!